Vancouver, B.C. – June 6, 2024 - Pacific Ridge Exploration Ltd. (PEX: TSX Venture; PEXZF: OTCQB; PQWN: FSE) ("Pacific Ridge" or the "Company”) is pleased to announce its 2024 exploration plans which include a diamond drill program at the Chuchi copper-gold project (“Chuchi”), Z-Axis Tipper Electromagnetic (“ZTEM”) and magnetotellurics (“MT”) geophysical surveys at the Kliyul copper-gold project (“Kliyul”) and an induced polarization (“IP”) survey at the Redton copper-gold project (“Redton”). Chuchi, Kliyul, and Redton are located in the prolific Quesnel terrane in northcentral British Columbia (see Figure 1).

Highlights:

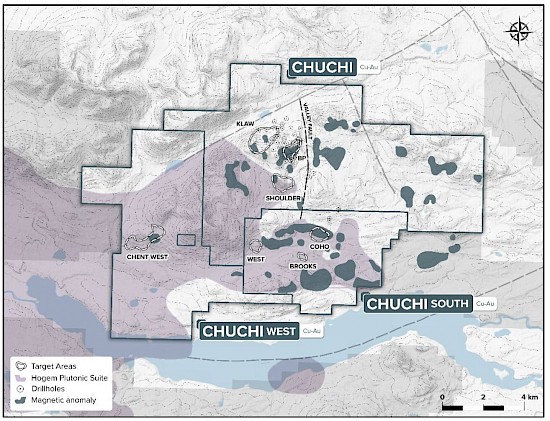

- Chuchi: Pacific Ridge is planning to drill 2,400 m at Chuchi in 2024. This will be the Company’s first ever drill program at Chuchi and will be focused on the BP Zone (see Figure 2). Pacific Ridge believes that the BP Zone has significant, untested potential for porphyry copper-gold mineralization at depth as many of the historic drill holes were shallow, less than 150 m in depth, and ended in mineralization (see Table 1 for BP Zone Drill Highlights). The drill program is expected to commence mid-August.

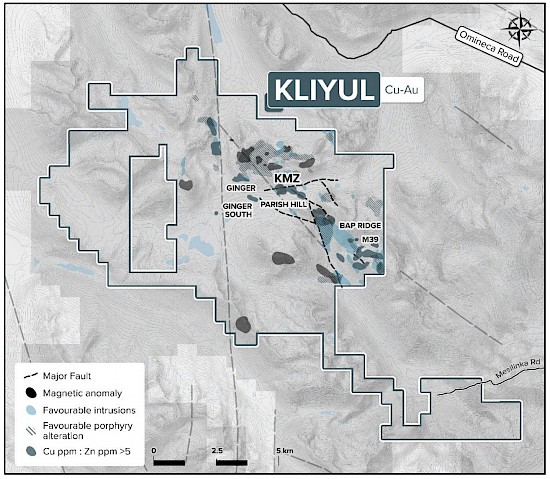

- Kliyul: Pacific Ridge is planning ZTEM and MT geophysical surveys at Kliyul this year to aid in the discovery of higher-grade copper-gold mineralization and a porphyry centre or centres. The last hole of the 2023 drill campaign, drill hole KLI-23-069, returned 45.0 m of 0.58% copper equivalent (“CuEq”)1 or 0.86 g/t gold equivalent (“AuEq”)2 (0.38% copper, 0.28 g/t gold, and 2.20 g/t silver) at a downhole depth of 584 m. This is the deepest mineralized interval ever encountered at Kliyul and the Company believes that it provides a vector for a higher-grade porphyry centre at the Kliyul Main Zone (“KMZ”) (see news release dated January 9, 2024). The ZTEM survey is expected to commence mid-July with the MT survey to follow.

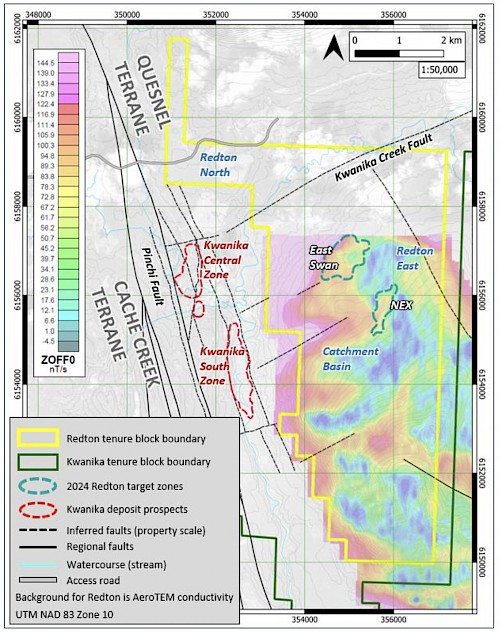

- Redton: Pacific Ridge is planning an IP survey at Redton, which adjoins the eastern boundary of NorthWest Copper Corp.’s Kwanika copper-gold deposit, to refine future drill targets. The IP survey is expected to commence in July.

Quote

“I’m very excited about the upcoming drill program because I believe, based on our exploration results, that we can extend copper-gold mineralization at Chuchi to depth,” said Blaine Monaghan, President & CEO of Pacific Ridge. “Also, I’m very optimistic that the ZTEM and MT surveys will aid in the discovery of higher-grade copper-gold mineralization and a porphyry centre at KMZ, and other porphyry centres within the six-kilometre-long mineralized trend at Kliyul.”

Figure 1

Location of Chuchi, Kliyul, and Redton

About Chuchi

Chuchi (or the “Project”) is over 160 km2 in size and comprises of three claim blocks, Chuchi, under option from Centerra Gold Inc. (“Centerra”)(TSX: CG)(NYSE: CGAU), and Chuchi South and Chuchi West, under option from American Copper Development Corporation (ACDX: TSXV). The Project is road accessible and is located approximately 35 km northwest of Centerra’s Mount Milligan Mine. Chuchi hosts several compelling exploration targets within a six-kilometre-long porphyry trend, including the BP Zone. The Company believes that that the BP Zone has significant, untested potential for porphyry copper-gold mineralization at depth as many of the historic drill holes were shallow, less than 150 m in depth, and ended in mineralization. Further, the porphyry centre has yet to be identified.

Figure 2

Chuchi Targets

Table 1

BP Zone Drill Highlights3

| Hole No. | From (m) | To (m) | Width (m) | Cu (%) | Au (g/t) | CuEq (%)4 | AuEq (g/t)5 |

|---|---|---|---|---|---|---|---|

| CH-89-7 | 38.0 | 138.0 | 100.0 | 0.27 | 0.37 | 0.51 | 0.76 |

| Includes | 82.0 | 98.0 | 16.0 | 0.71 | 1.32 | 1.60 | 2.37 |

| CH-90-27 | 32.0 | 226.0 | 194.0 | 0.21 | 0.21 | 0.35 | 0.52 |

| Includes | 156.0 | 226.0 | 70.0 | 0.31 | 0.34 | 0.54 | 0.80 |

| CH-90-30 | 98.0 | 256.0 | 158.0 | 0.22 | 0.10 | 0.29 | 0.43 |

| Includes | 182.0 | 256.0 | 74.0 | 0.26 | 0.13 | 0.35 | 0.52 |

| CH-90-33 | 54.0 | 304.5 Ɨ | 250.50 | 0.21 | 0.12 | 0.29 | 0.44 |

| Includes | 64.0 | 152.0 | 88.0 | 0.36 | 0.21 | 0.51 | 0.75 |

| CH-90-37 | 54.3 | 262.1 Ɨ | 207.8 | 0.22 | 0.12 | 0.30 | 0.45 |

| Includes | 110.0 | 154.0 | 44.0 | 0.35 | 0.18 | 0.47 | 0.70 |

| CH-91-40 | 50.0 | 130.0 | 80.0 | 0.30 | 0.29 | 0.49 | 0.73 |

| Includes | 50.0 | 114.0 | 64.0 | 0.35 | 0.33 | 0.57 | 0.85 |

| Includes | 64.0 | 104.0 | 40.0 | 0.45 | 0.41 | 0.73 | 1.08 |

| CH-91-42 | 91.4 | 320.6 Ɨ | 229.2 | 0.10 | 0.61 | 0.51 | 0.76 |

| Includes | 94.0 | 144.0 | 50.0 | 0.09 | 2.10 | 1.50 | 2.23 |

| Includes | 94.0 | 122.0 | 28.0 | 0.07 | 3.61 | 2.49 | 3.70 |

| And | 200.0 | 242.0 | 42.0 | 0.13 | 0.55 | 0.50 | 0.74 |

| CH-19-003 | 91.5 | 411.0 Ɨ | 319.5 | 0.16 | 0.14 | 0.25 | 0.37 |

| Includes | 341.0 | 401.0 | 60.0 | 0.26 | 0.24 | 0.42 | 0.63 |

About Kliyul

Owned 100% by Pacific Ridge, Kliyul is over 90 km2 in size and is located in the prolific Quesnel terrane close to existing infrastructure. Kliyul hosts several compelling exploration targets within a six-kilometre long mineralized trend, including KMZ (see Figure 3), which has been the Company’s focus since 2020. Pacific Ridge has completed more than 17,500 m of diamond drilling at KMZ and has expanded the known mineralized extents to 760 m east-west, up to 600 m north-south, and up to 650 m vertical. KMZ remains open in every direction and at depth. Drill highlights include drill hole KLI-21-037 which returned 316.7 m of 0.79% CuEq1 or 1.17 g/t AuEq2 (0.30% copper, 0.70 g/t gold, and 2.17 g/t silver) within 566.7 m of 0.51% CuEq1 or 0.75 g/t AuEq2(0.20% copper, 0.44 g/t gold, and 1.31 g/t silver) (see news release dated January 31, 2022).

To view all Pacific Ridge’s drill results from Kliyul, click on the link below.

https://pacificridgeexploration.com/site/assets/files/5969/2024-01-12_kliyul_assay_highlights_summary.pdf

Figure 3

Kliyul Targets

About Redton

Owned 100% by Pacific Ridge, Redton is over 34 km2 in size and adjoins the eastern boundary of NorthWest Copper Corp.’s Kwanika copper-gold deposit. Several target areas exist at Redton: Catchment Basin, East Swan, NEX, Redton East, and Redton North. In 2022, after completing a targeted soil survey grid, the Company identified a surface geochemical target, the NEX zone, which is of similar size and orientation as the Kwanika Central Zone footprint. NEX zone is located 4.5 km east of Kwanika following an interpreted arc-transverse lineament and an AeroTEM geophysical feature of interest (see Figure 4).

Figure 4

Redton Targets

About Pacific Ridge

Our goal is to become B.C.’s leading copper-gold exploration company. Pacific Ridge’s flagship asset is its 100% owned Kliyul copper-gold project, located in the Quesnel terrane close to existing infrastructure. In addition to Kliyul, the Company’s project portfolio includes the Chuchi copper-gold project, the RDP copper-gold project, the Onjo copper-gold project, and the Redton copper-gold project, all located in British Columbia. The Company would like to acknowledge that its B.C. projects are located in the traditional, ancestral and unceded territories of the Gitxsan Nation, McLeod Lake Indian Band, Nak’azdli Whut’en, Takla Nation, and Tsay Keh Dene Nation.

On behalf of the Board of Directors,

“Blaine Monaghan”

Blaine Monaghan

President & CEO

Pacific Ridge Exploration Ltd.

Investor Relations:

Tel: (604) 687-4951

Email: ir@pacificridgeexploration.com

Website: www.pacificridgeexploration.com

LinkedIn: https://www.linkedin.com/company/pacific-ridge-exploration-ltd-pex-/

Twitter: https://twitter.com/PacRidge_PEX

1CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x AuR/CuR x $Au x 0.032151) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Cu x 22.0462).

2AuEq = ((Au(g/t) x $Au x 0.032151) + ((Cu%) x CuR/AuR x $Cu x 22.0462) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Au x 0.032151).

Commodity prices: $Cu = US$3.25/lb, $Au = US$1,800/oz., and Ag = US$20.00/oz.

There has been no metallurgical testing on Kliyul mineralization. The Company estimates copper recoveries (CuR) of 84%, gold recoveries (AuR) of 70%, and silver recoveries (AgR) of 65% based on average recoveries from Kemess Underground, Mount Milligan, Red Chris.)

Factors: 22.0462 = Cu% to lbs per tonne, 0.032151 = Au g/t to troy oz per tonne, and 0.032151 = Ag g/t to troy oz per tonne

3Sources include: Chuchi project historical drilling database; also reported in BC Geological Survey (Branch) Assessment Reports 20018 (CH-89-7), 21113 (CH-90-27, CH-90-30, CH-90-33, CH-90-37), unpublished Placer Dome Inc. database (CH-91-40, CH-91-42), 39061 (CH-19-003).

4CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x AuR/CuR x $Au x 0.032151) / ($Cu x 22.0462).

5AuEq = ((Au(g/t) x $Au x 0.032151) + ((Cu%) x CuR/AuR x $Cu x 22.0462) / ($Au x 0.032151).

Commodity prices: $Cu = US$3.25/lb and $Au = US$1,800/oz.

There has been no metallurgical testing on Chuchi or Kliyul mineralization. The Company estimates copper recoveries (CuR) of 84%, and gold recoveries (AuR) of 70% based on the average recoveries from Kemess Underground, Mount Milligan, and Red Chris.

Factors: 22.0462 = Cu% to lbs per tonne and 0.032151 = Au g/t to troy oz per tonne.

Ɨ End of hole

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The technical information contained within this News Release has been reviewed and approved by Danette Schwab, P.Geo., Vice President Exploration, and a Qualified Person as defined by National Instrument 43-101 policy.

Forward-Looking Information: This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, which address exploration drilling and other activities and events or developments that Pacific Ridge Exploration Ltd. ("Pacific Ridge") expects to occur, are forward-looking statements. Forward looking statements in this news release include the planned 2,500 m drill program at Chuchi, the planned ZTEM and MT surveys at Kliyul, and the planned I.P. survey at Redton. Although Pacific Ridge believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. These statements are based on a number of assumptions including, among other things, assumptions regarding general business and economic conditions, that one of the options will be exercised, the ability of Pacific Ridge and other parties to satisfy stock exchange and other regulatory requirements in a timely manner, the availability of financing for Pacific Ridge’s proposed programs on reasonable terms, and the ability of third party service providers to deliver services in a timely manner. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Pacific Ridge does not assume any obligation to update or revise its forward-looking statements, whether because of new information, future events or otherwise, except as required by applicable law.