Chuchi

-

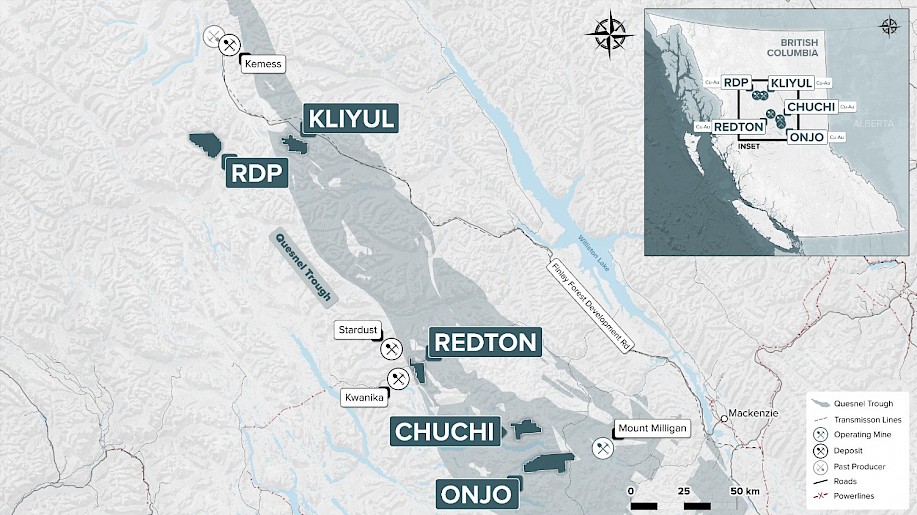

Under option from Centerra Gold, Chuchi is located in the prolific Quesnel Terrane, approximately 35 km northwest of Centerra Gold's Mount Milligan Mine (See Figure 1). Chuchi is road accesible and hosts several compelling exploration targets.

Figure 1

The Quesnel Terrane, North Central British Columbia

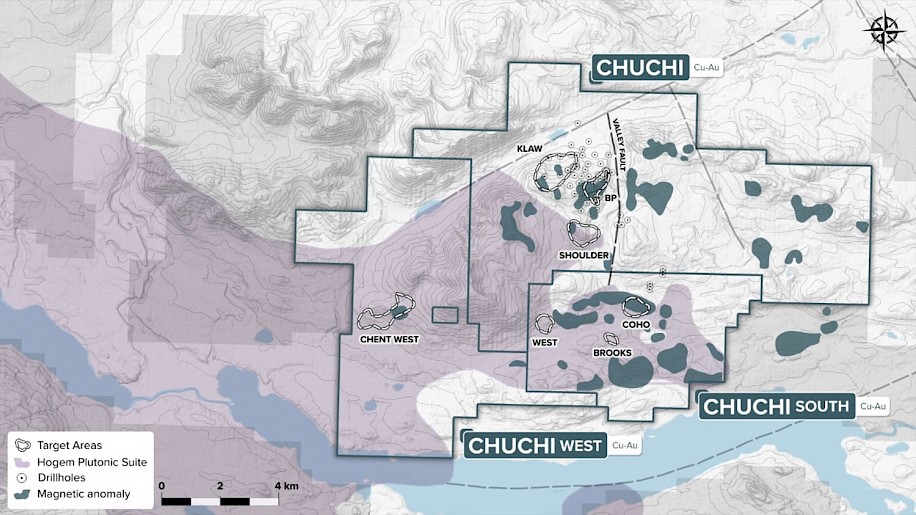

Chuchi is underlain by lower Jurassic volcanic and sedimentary rocks of the Takla Group (Chuchi Lake succession). Porphyry copper-gold mineralization at the BP and Rio Algom Zones is associated with a cluster of early Jurassic monzodiorite to syenite porphyry intrusions, dated at 188.5 Ma ± 2.5 Ma. The main BP Zone is defined by 4 km x 3 km halo of outer propylitic alteration surrounding a central 1.5 km x 1.5 km area of copper-gold mineralization, which is open to depth and potentially to the east across the north-south trending Valley Fault (see Figure 2)1.

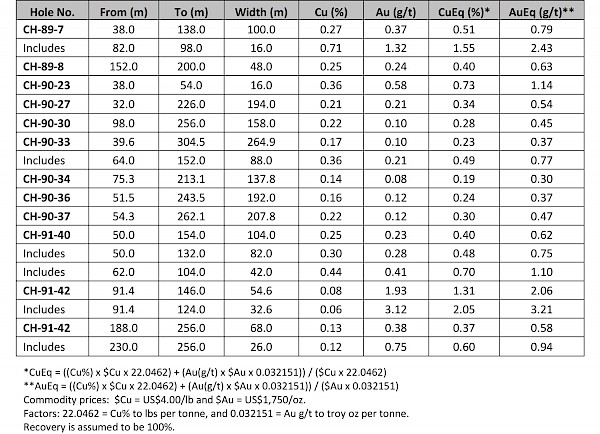

Chuchi has a long history of exploration by companies such as Noranda, BP, Rio Algom, Kiska Metals and AuRico, including 8,886 m of drilling in 48 holes, of which 39 holes have targeted the main BP Zone. An additional 27 holes were drilled in 1991, but the records for this drilling have been lost. Most of the drilling was shallow, less than 150 m in depth, with many of the drill holes ending in mineralization. Grades within the mineralized portion of the BP Zone range from 0.21% to 0.4% Cu and from 0.21 g/t to 0.44 g/t Au (see Table I). Pacific Ridge believes that the core of the porphyry system has yet to be identified. The Project also contains other targets that could represent porphyry centres.

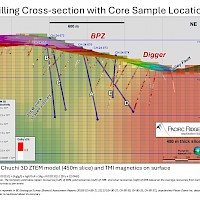

In 2022, Pacific Ridge completed an airborne ZTEM resistivity survey and a surface exploration program consisting of mapping, sampling, and core re-logging. In 2023, the Company completed an IP program. In 2024, the Company completed 2,716m in five diamond drill holes (CH-24-070 to CH-24-074) over a 750m strike length across the BP Zone. Results suggest that drilling encountered the upper part of a large porphyry copper-gold system that has not been adequately tested and remains open laterally and to depth.

Figure 2

Chuchi Targets

Table I1

BP Zone Drill Highlights

1 See news release May 9, 2022

Acquisition terms (Chuchi)

Pacific Ridge has the right to earn a 51% interest in Chuchi by making cash payments totaling $60,000, issuing 2.0 million shares, and spending $5 million on exploration by the fourth anniversary of the agreement. The Company then has the right to increase its interest in the Project to 75% by making additional payments totaling $100,000, issuing 1.5 million shares and completing an additional $5 million in exploration by the sixth anniversary of the agreement. The agreement is subject to regulatory approval. Various claims are subject to up to 6% in net smelter royalties, which can be bought down to 2.1%.

The Company will also pay a finder’s fee of $15,000 on signing of an agreement and $5,000 each 6 months thereafter plus 2% on exploration expenditures after certain other property payments have been made.